Video: Discussion Panel, Blockchain for Refugees at Station F Techfugees Summit, 2018.

The Lebanese economy is stagnant, and refugees are the most at risk to face the worst economic crisis of the country in 150 years. In a span of a little less than 2 years, Lebanon went from a country known for its growing middle-class and its hospitality towards refugees to one with an inflation of over 281% and a soaring unemployment rate. ¾ of the population is currently living in poverty and over 1/3rd is in a situation of extreme poverty (United Nations Report, Sept 3rd, 2021). A self-inflicted crisis created by a corrupted government – that has been made worse by the COVID pandemic and the massive explosion at the Port of Beirut.

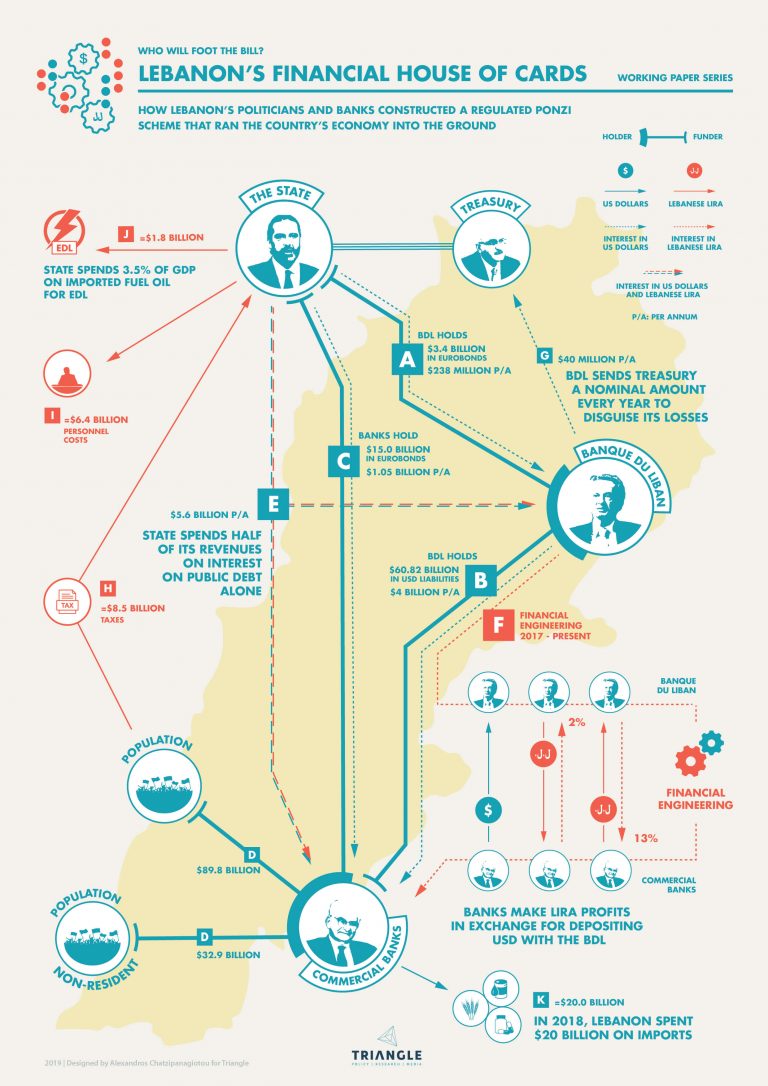

How did Lebanon end up in this catastrophic situation in such a short time?

To stabilize its currency and encourage importation, the Lebanese Central bank tied the value of its currency – the Lira – to a stronger currency – the U.S dollar. In 1997, the President of the Central Bank – Riah Salameh – declared that one U.S.D would equal 1.500 Lebanese Lira (L.L). Maintaining such a rate required Lebanon to have a big supply of dollars, and for a long time that wasn’t a problem: the wealthy diaspora around the world kept sending its dollars to Lebanon to benefit from advantageous interest rates, and the country could rely on Gulf allies to supply dollars in case of a crisis. For many years, this strategy worked and allowed the Lebanese economy to keep its currency stable even during the tough times.

But a decade ago, the dollar influx suddenly slowed down: investors from Gulf countries and the diaspora became doubtful of Lebanon’s financial stability due to the high level of corruption within the government. The rise of Hezbollah in Lebanon – perceived as an Iranian proxy – made Arab countries like the UAE and Saudi Arabia less inclined to invest in Lebanon by fear of the funds being used by Hezbollah for its own gain. The war in Syria made it very difficult as well for Lebanon to export anything, leaving the Lebanese economy vulnerable to a crisis.

In response to the situation, the Central bank, with the help of local commercial banks, decided to borrow dollars from the Lebanese people in exchange for extremely competitive interest rates. To be able to keep this going, the Central bank turned to new investors to pay off the old ones, creating a “Ponzi scheme”. It all collapsed when new investors – suspicious of the Central Bank’s policy – decided to stop investing.

Everything went rogue during the summer of 2019, when people found themselves unable to withdraw dollars from their accounts and when the government announced that it would impose a tax on WhatsApp calls.

Sick and tired of years of corruption, the entire country erupted in protests. Banks closed during the protests, so people were not able to access their money anymore. A black market rapidly emerged with the possibility of exchanging dollars, among other commodities. The Lira lost 90% of its value.

Today on the black market, $1 costs almost 21.000 Lira (versus 3.900 L.L for the official rate. Source: lirarate.org). Most people have lost their savings and saw the value of their salary significantly reduced. Buying groceries has become unaffordable for the majority of households in Lebanon. The lack of reforms from the government and the absence of a coherent monetary plan to resolve the crisis has finished destroying people’s faith in the Lebanese system.

What alternative for refugees and the Lebanese population after the death of the Lebanese Lira?

With the death of the Lebanese Lira, the Lebanese people have to find another way to exchange money to survive. According to the joint UNHCR & UNICEF Vulnerability Assessment of Syrian Refugees of 2020 (VaSyR), more than 1.5 million refugees are living in Lebanon, of whom about 78 percent lack legal status. Without official documents, it is almost impossible to open a bank account in Lebanon and to receive money for daily expenses.

Initially, most refugees turned to their main alternative: sending and receiving cash from cash out companies like Western Union and MoneyGram. But this option presented some flaws: such companies have varying commission fees and have been reported unable to deliver fresh dollars in some cases. There are often long waiting lines and withdrawals are subject to the stores’ opening business hours. Digital banks were another alternative, but they either have strict KYC policies or lack a cash-out option, which makes them very impractical (see our latest article on the topic here).

What’s left then? With Techfugees, we’ve been exploring if cryptocurrencies could be an alternative. Exchanging cryptocurrencies online doesn’t require refugees to provide any ID or residency address. With crypto, you pay a low commission fee (from 1% to 5% on average) and the transfer is made within minutes. Before the crisis, there were some barriers to the adoption of crypto as a way to exchange money: many currencies were not considered as stable (“shitcoins”), and even stronger currencies like Bitcoin were known to fluctuate often.

The government – feeling threatened by crypto since it isn’t regulated and controlled by the Central Bank – adopted several restrictive measures against it to limit its adoption. The fact that crypto is digital and not cash-based also contributed to the lack of adoption by the general public, who didn’t consider it as a serious solution for its economy: if anything, crypto was perceived as a way to make rapid gains and then cash-out on them. But the crisis changed everything: the digital-savvy, smartphone-equipped youth doesn’t trust the Lebanese banking system anymore and people are in urgent need of a new currency. With crypto, Lebanese refugees have found a way to solve major daily life issues: one that allows them to get paid by their employer, to send money to friends and family, and to save capital without complying with the rules of the Central Bank.

In the face of absolute necessity, crypto has rapidly become a way for refugees in Lebanon to escape restrictions on withdrawals, avoid skyrocketing exchange rates and go around legal paperwork constraints. The firm Thomson Reuters stated that the majority of transactions that are happening within the crypto space in Lebanon today are made in « stablecoins » such as Tether (also called « USDT), because of their indexation on the U.S dollar (1 USDT = 1$).

The reasons behind the choice of stablecoins to replace Lira are quite straightforward:

- At the moment, there is no need for legal documents or a Residency Permit. Anyone can create a Digital Wallet. Transactions are completed within minutes at a minimal fee.

- They offer more stability since they are indexed on the U.S dollar or a strong commodity like Gold.

- They can be exchanged for other digital currencies like Bitcoin (which is the most used digital currency on the planet). Even though the value of Bitcoin is volatile, it is the strongest digital currency on the planet and one that is capable of bringing financial returns to its owner. Therefore, it is still preferred to the Lebanese Lira, whose value has already plummeted.

- They can easily be exchanged for U.S dollars, which makes them a reliable form of currency to use to store capital abroad or send it to friends or family members who can exchange it for dollars themselves.

- They are not subject to the rules of the Central Bank.

In response to the crisis, refugees in Lebanon are increasingly trading their money for USDT or Bitcoin to buy goods through peer-to-peer “trading groups” on social platforms like Whatsapp and Telegram. Most of the crypto exchanges are happening through informal networks, which makes it difficult to estimate the exact adoption rate: however, six cryptocurrency traders told Thomson Reuters that millions of dollars worth of cryptocurrency were traded every day in Lebanon (source: Thomson Reuters). The number of Digital Wallet downloads has grown significantly in the last year.

So far, the process of exchanging crypto is mainly based on trust. To avoid scams, you have to be invited by a friend to enter a group. Every day, participants post offerings that range from a few hundreds of dollars worth of crypto to thousands of dollars worth. When someone wants to sell Lira or exchange goods to buy Bitcoin, for example, he is paired with a seller in the group who owns Bitcoin. Then, the two participants meet physically to exchange cash against a Bitcoin transfer – a method commonly referred to as “Over-The-Counter” or OTC – and the seller takes a commission anywhere between 1% and 5% of the total amount. Bitcoin OTC resellers are flourishing in Lebanon since most people are looking for a side hustle that allows them to make money in another currency than the Lira.

However, this process is not without setbacks:

- It is not regulated, hence subject to scams.

- Even if it is one of the strongest cryptocurrencies at the moment – Bitcoin is still highly volatile.

- Crypto is – generally speaking – quite misunderstood by the general public. Not everyone knows how it works or how to set up a digital wallet. What doesn’t look familiar and grounded in something palpable can easily look scary. Therefore, there is a strong need to educate people around crypto and to set up regulations that encourage positive use.

For this article, I spoke to Tey El Rjula, Founder of Fluus.Finance, who was invited back in 2018 at Techfugees Global Summit and again in December 2020 for a virtual meetup in Lebanon.

Fluus.finance is a growing ecosystem of fintech services that offers everyone (banked and unbanked alike) a digital infrastructure for sending and receiving value. Tey’s vision for the company is to « turn invisible people into invincible ones » by leveraging the financial innovations behind crypto wallets / decentralized finance. He also wants to tackle the lack of education around those innovations, which prevents people from reaping the benefits of crypto.

Having experienced the refugee status, Tey used Bitcoin and cryptocurrency trading to solve the challenges he faced and is now an established tech entrepreneur and cryptocurrency advocate.

So, how does the Fluus.Finance app work?

“Fluus.Finance is a combination of three digital financial services”, Tey told me. “Fluus Wallet, to send and receive cryptocurrencies on one’s device, Fluus Pay, to transform one’s smartphone into a POS device, and Fluus Asset Management, to manage investments. Those three products complement each other in an all-inclusive ecosystem, but can also be used individually. Together they open the door for fast and cheap online remittance, payment processing, off-ramp solutions, and decentralized investment tools.”

Fluus Wallet

A web 3.0 compatible biometric wallet. The tedious process of backing up keys using paper-based seed phrases is replaced with the use of biometric solutions. Send and receive cryptocurrencies and swap one asset for another.

Fluus Pay

Turns your smartphone into a POS device. Fluus Pay allows users in the Middle East & African regions to make purchases offline and online by scanning QR codes.

Fluus Asset Management

With built-in accounting tools, Fluus Asset Management (FAM) gives crypto investors access to numerous staking and DeFI opportunities that enable them to earn interest at the best rates possible.

To make it easier and more familiar for people to adopt crypto, Tey also emphasizes the importance of his onboarding service:

“The tedious process of backing up non-custodial wallets is a turn-off and a barrier to many people, including refugees, so we spend time with each person to explain how crypto works and help them download a digital wallet on their phone. Then, we guide them in buying through trusted p2p agents that we know and vet.

Language is another issue, since most crypto platforms, information, and news outlets are in English. Many people want to enter the space but their English level is not good enough to go down the rabbit hole of crypto.

Fluus Finance adds value because it prevents people from getting scammed by offering a reliable business service, in their language. It also helps them to better understand how they can benefit from using crypto in a simple, safe, and sovereign manner. For refugees, it has become a lifeline to escape poverty and recover their money. Crypto and Blockchain are giving hope to people and businesses in Lebanon because they take out banks from the equation and they provide the transparency needed to prevent corruption.”

Video: Crypto after Crisis – October 28th, 2021

Blockchain & cryptocurrencies, a solution to rebuild the Lebanese economy?

Peer-to-peer payments through digital wallets are carried out on Blockchain public networks. “The Blockchain technology on which crypto operates is basically like a distributed database that runs on millions of computers. It’s open-source, so everyone can see the history of transactions and it doesn’t require powerful intermediaries to authenticate or to settle transactions. It’s peer to peer, which means that every transaction is subject to verification and validation by network members (or nodes) in a process known as “mining”. Miners are users who validate the new transaction to record it on the blockchain. After the validation of the block, it is time-stamped and linked to the other block chronologically (hence chain), to then become visible to every user who is on the blockchain […] Everything that is centralized is vulnerable to be hacked, plus it slows down the process. Blockchain disperses power and authority to the masses” (Boisard, A.n.d).

In other words, Blockchain technology decentralizes power, provides more transparency and accelerates the transaction process. For people and businesses, it means fewer constraints to access and to move money, complete ownership of one’s assets, and an ability to easily detect attempts of fraud. For refugees, it also means having a digital identity through which to access economic opportunities like employment and to recover a sense of inclusion into society.

For refugees, several applications of blockchain for financial inclusion already exist and can be used as stepping stones to implement other effective solutions, if we take into account the learnings regarding consent and data protection that were recently widely shared. The largest initiative in that regard has been conducted by the World Food Program since 2017 under the name “Building Blocks” (for more information: World Food Program: Blockchain for Zero Hunger – Graduated Project) and has now scaled to serve over 1 million people in Pakistan and Jordan. The project focuses on using a private Blockchain network coupled with UNHCR’s biometric authentication technology in camps to authenticate and register humanitarian transactions without intermediaries. The humanitarian cash value is distributed to refugees in camps on an account kept in the Blockchain and they can shop for goods in-store using biometric identification. This system saves transaction fees and allows greater privacy and security for the refugees.

Crypto and blockchain, however, are not going to solve problems by themselves, and thinking that those technologies alone will act as saviors would be a mistake. They have yet to prove that they can become sustainable solutions to the crisis over the long term – and there are major issues that need to be tackled: decentralization may increase transparency for instance, but it doesn’t automatically guarantee inclusion, and the public nature of blockchain raises many privacy concerns. For Blockchain & Crypto to have a lasting impact at scale, it will be necessary for all stakeholders to engage in an open conversation where regulators can establish clear data protection and privacy laws, where NGOs can iterate projects based on field data, and where tech companies design solutions while engaging local communities.

According to Tey, the key to this shining future is the harmonization of peer-to-peer digital currency trading through the adoption of regulations that benefit the Lebanese people. That would require the population to fully embrace the fact that digital currencies open new opportunities that didn’t exist with traditional forms of money – and to actively engage in structuring their applications. This is why services like Fluus are vitally important to increase awareness around crypto and advocate for it as a path to take to rebuild Lebanon’s economy. The Lebanese government, which has failed so far to come up with a solid plan, is also at a junction: it has to decide whether or not it is going to support its people in launching a Lebanese digital currency – for its survival as well as for its people.